Changes to aged pension rules

From 1 January 2017 Government changes to the Age Pension are likely to reduce many Age Pension recipient’s entitlements. It’s important that you understand how the changes could affect you.

Increase in the Assets Test threshold

The Assets Test threshold is the amount of assets pensioners can hold before their pension starts to reduce under the Centrelink Assets Test. The table below shows the new thresholds from 1 January 2017.

| Family situation | Assets Test threshold |

| Single, homeowner | $250,000 |

| Single, non-homeowner | $450,000 |

| Couple, homeowner | $375,000 |

| Couple, non-homeowner | $575,000 |

Increase in the ‘taper rate’

The taper rate is the rate at which the Age Pension reduces as assets increase. From 2017 the taper rate will increase from $1.50 a fortnight to $3 a fortnight. This means the maximum Age Pension a pensioner can receive will be reduced by $3 per fortnight for every $1,000 of assets they hold above the Assets Test threshold.

How the changes could affect your Age Pension

The higher Assets Test thresholds will generally mean:

- Age Pension recipients with an asset value ‘around’ the thresholds are likely to see an increase in their Age Pension entitlement, and

- Age Pension recipients with assets above the threshold are likely to see a reduction in their Age Pension – in some cases to zero – as a result of the increased taper rate.

Example

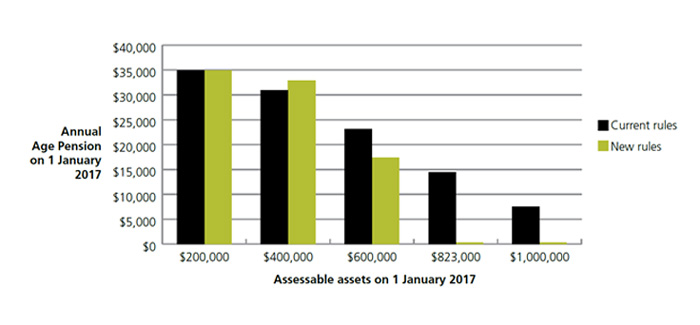

Retired couple Betty and John are both 68 years old and own their home. They have $823,000 in total assets and currently receive a part Age Pension of $500 per fortnight. If their assets remain unchanged on 1 January 2017, their Age Pension is estimated to reduce to zero. If their assets either increase or decrease, the new rules could still impact their pension and the likely impact to Betty and John’s Age Pension entitlements at various asset levels is explored in the chart below (see note 1).

Based on information released by the Government and can be found here. The chart also assumes all assets are financial assets subject to deeming.

The changes to the Age Pension can affect pensioners in a number of ways. To find out more about the likely impact of these changes on your entitlements and to explore strategies to help reduce the impact, call your PPT representative on (03) 5331 3711.

> Download the Aged Pension Changes summary flyer care of Challenger here.

SOURCE: Challenger

DISCLAIMER: The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.